How To Benefit From Gran Canaria's Unique Tax Benefits

Published in Legal & Tax, Living in Gran Canaria

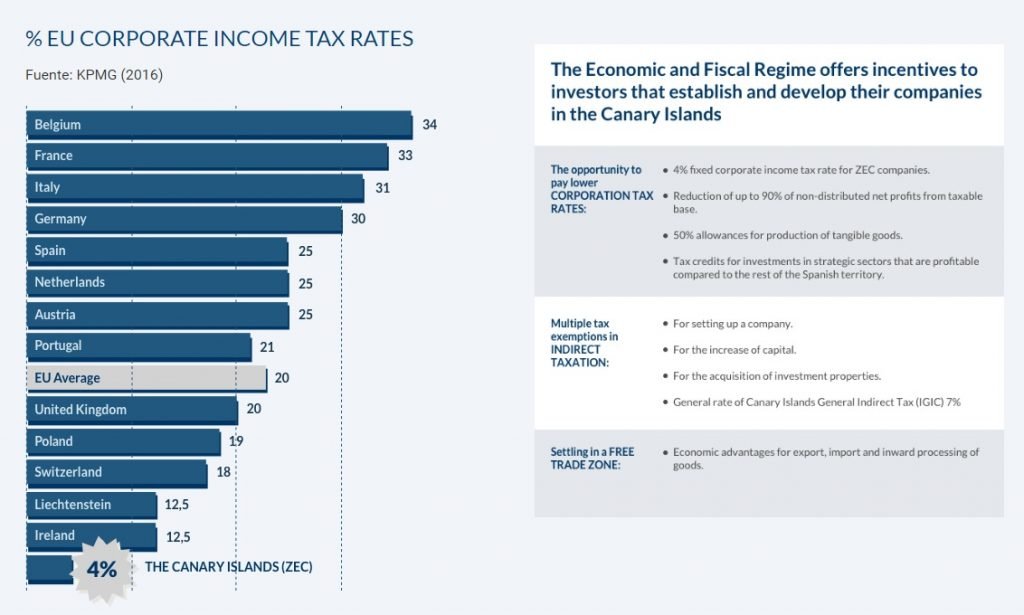

Gran Canaria and the Canary Islands offer resident business owners and entrepreneurs generous tax benefits that are unique in Europe. The main benefit is that companies incorporated in the Canary Islands Special Zone (ZEC) only have to pay 4% corporation tax. This compares to average of 25-30% in other areas of the EU. Other advantages include an exemption from tax on dividends distributed by ZEC subsidiaries to their parent companies in the European Union and other countries with which Spain has signed an agreement to avoid double taxation. ZEC companies are also exempt from Transfer Tax and Stamp Duty Gran Canaria companies also benefit from the low rate of VAT in the Canary Islands. This IGIC tax is currently 6.5% compared to 21% in the rest of Spain. ZEC companies are even exempt from IGIC when they trade goods and services with other ZEC entities.

Other benefits of business in Gran Canaria

Of all the Canary Islands, Gran Canaria is the most enticing to business and entrepreneurs. It has the archipelago's busiest port and biggest city, a thriving tourism industry and a growing oil services industry. Its airport connects to cities all over Europe and Africa and the island's healthcare and transport network is modern and up to EU standards. The island's university produces quality graduates and salaries in Gran Canaria are low compared to many countries in Europe. What really makes Gran Canaria stand out however is the lifestyle that it offers. With warm sunny weather, a thriving restaurant and cultural scene and a laid back atmosphere, it is an ideal location and very attractive to employees. Gran Canaria is an island where you can live and work and be happy.

Opening a Gran Canaria ZEC company: The terms and conditions

Such generous tax benefits do come with conditions but these are not too strict. A ZEC company must be approved by the official ZEC Corporation and must invest at least €100,000 in fixed assets (such as property) within two years of incorporation. A ZEC must also create five full-time jobs in the Canary Islands, have a director who is resident in the archipelago, and have its registered office and place of effective management in the islands. There are specific activities suitable for this incentive, mainly technological and industrial activities that diversify the island's economy and make it less dependant on tourism.

Thinking of opening a ZEC company in Gran Canaria?

At Cárdenas Real Estate we have 39 years of experience in the south Gran Canaria property market and a specialist legal and tax department dedicated to property matters. As a successful Gran Canaria company we can help you to find the perfect place to live and refer you to reliable and experienced lawyers and accountants who can advise you on how to go about setting up a ZEC corporation in Gran Canaria