23 Nov 2011

Letter from the Spanish Tax Office regarding Income and Wealth Tax

Published in Legal & Tax

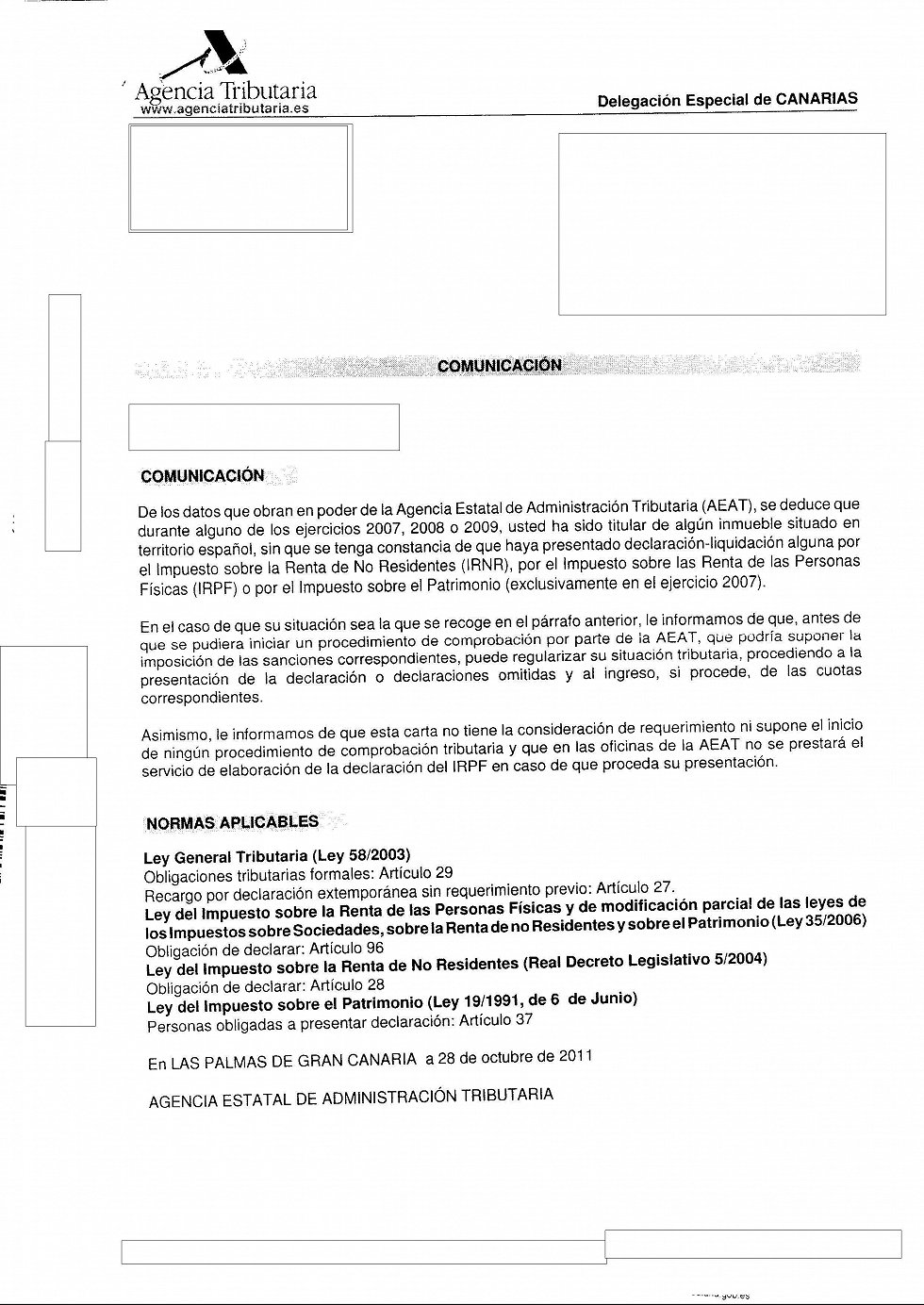

The Spanish Tax Office has recently been sending letters to many non-resident owners, referred to the tax years 2007, 2008 and 2009 and pointing out the fact that having owned a property during one of the said years implies an obligation to file an Income Tax return as well as a Wealth Tax return (the latter for 2007 only).

With such a letter, the Tax Office is simply warning that they are going to check if the above tax obligations have been fulfilled, and they offer the possibility to “make it up” by presenting the missing tax returns and paying the corresponding taxes before the Tax Office opens an investigation, claims the unpaid tax amounts and imposes a fine.

As expressly pointed out in the letter, the same is not an express request or summons (therefore you do not need to answer it) and it does not signify either that an investigation has already been started. It further points out that not assistance will be given at the Tax Office for preparing tax returns in arrears.

Therefore if you have received such a letter you just need to check if you have filed the tax returns for the years in question. If not, it should be done as soon as possible, to avoid unpleasant consequences and fines.

If you need help, please be aware that at CARDENAS we have been taking care of such tax matters for many many years, and that we can assist you further in that respect.

The Spanish Tax Office has recently been sending letters to many non-resident owners, referred to the tax years 2007, 2008 and 2009 and pointing out the fact that having owned a property during one of the said years implies an obligation to file an Income Tax return as well as a Wealth Tax return (the latter for 2007 only).

With such a letter, the Tax Office is simply warning that they are going to check if the above tax obligations have been fulfilled, and they offer the possibility to “make it up” by presenting the missing tax returns and paying the corresponding taxes before the Tax Office opens an investigation, claims the unpaid tax amounts and imposes a fine.

As expressly pointed out in the letter, the same is not an express request or summons (therefore you do not need to answer it) and it does not signify either that an investigation has already been started. It further points out that not assistance will be given at the Tax Office for preparing tax returns in arrears.

Therefore if you have received such a letter you just need to check if you have filed the tax returns for the years in question. If not, it should be done as soon as possible, to avoid unpleasant consequences and fines.

If you need help, please be aware that at CARDENAS we have been taking care of such tax matters for many many years, and that we can assist you further in that respect.